Dental Equipment and Consumables Market Size Worth USD 67.75 Billion by 2034 Driven by Oral Care Awareness and Innovation

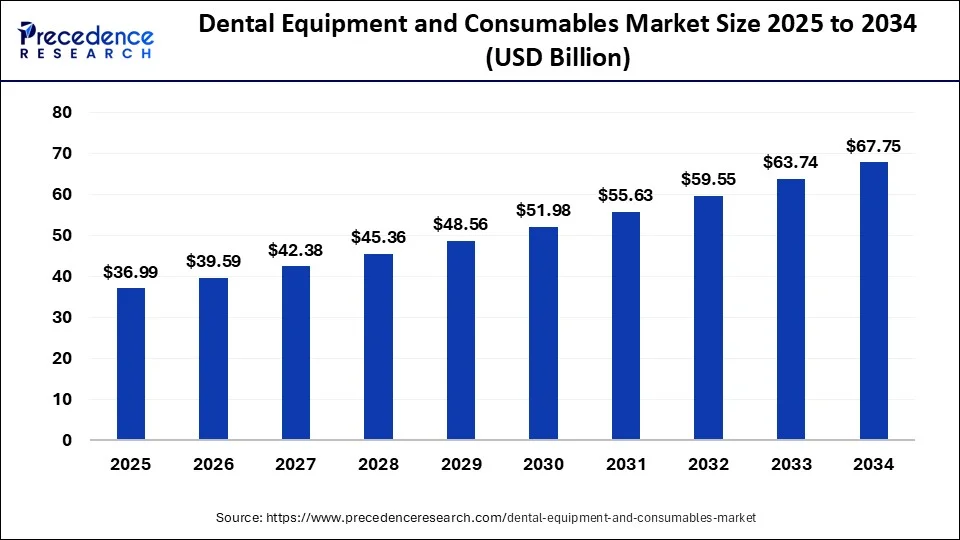

According to Precedence Research, the global market size will grow from $36.99 billion in 2025 to nearly $67.75 billion by 2034, with a CAGR of 6.96% from 2025 to 2034, driven by rising oral health awareness, adoption of advanced technologies like digital imaging and CAD/CAM, and supportive government healthcare initiatives. North America dominated the market by holding more than 41% of the market share in 2024.

Ottawa, Sept. 25, 2025 (GLOBE NEWSWIRE) -- The global dental equipment and consumables market size is expected to be worth over USD 67.75 billion by 2034, increasing from USD 36.99 billion in 2025. The industry is growing at a CAGR of 6.96% from 2025 to 2034. The market is driven by the rising prevalence of oral diseases and increasing demand for advanced dental care solutions

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/3952

Market Key Takeaways:

- In terms of revenue, the global dental equipment and consumables market was valued at USD 34,560 million in 2024.

- It is predicted to cross more than USD 67,750 million by 2034.

- The dental equipment and consumables market is expected to expand at a CAGR of 6.96% from 2025 to 2034.

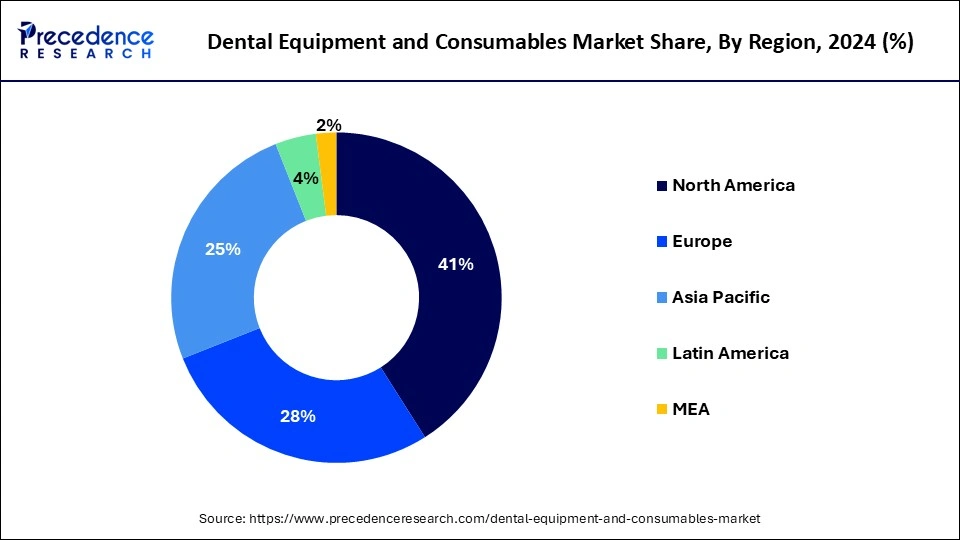

- North America held the largest market share of 41% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By product, the equipment segment dominated the market in 2024.

- By product, the consumables segment is growing at a notable CAGR from 2025 to 2034

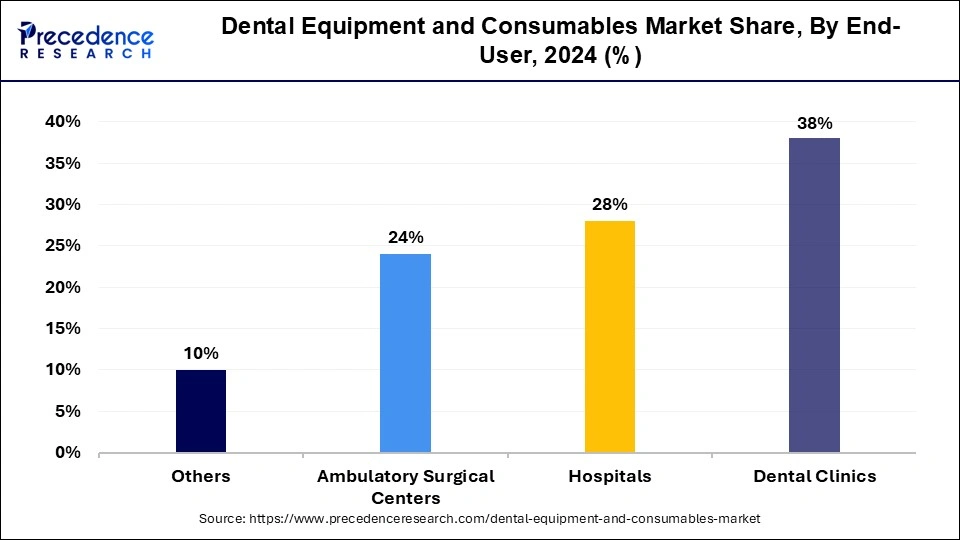

- By end-user, the dental clinics segments accounted for the largest market share of 38% in 2024.

What are Dental Equipment and Consumables?

Dental equipment and consumables are the fundamental tools, instruments, and materials that are used by dentists, dental hygienists, and laboratories to diagnose, treat, and maintain oral health. These comprise products like dental drills, cements, amalgams, plaster, and hand tools, which play a major role in dental routine and advanced dental procedures.

Access to modern dental care has been increased by increasing government spending on healthcare and oral health awareness campaigns. Increased disposable income and the increased use of dental insurance have also lowered the costs of the treatments. Also, healthcare system changes, an increase in the level of education, and improvements in dental technologies are further driving market growth around the globe.

Key Stats: Dental Equipment & Consumables Market (Consumption, Production, Demand)

- Around 25 million dental prosthetics (crowns/bridges) were digitally manufactured globally in 2023.

- Over 80,000 intraoral scanners are actively used in dental practices worldwide, with significant year-over-year growth.

- Approximately 35,000 new dental laser units were installed globally in 2023.

- Over 9,800 metric tons of dental resin-based materials were distributed globally in 2024.

- More than 2.1 million ceramic block units (like lithium disilicate) were sold in 2024 for dental use.

- Approximately 1,200 tons of dental amalgam were consumed in emerging economies in 2024.

- Around 1.4 million ultrasonic scaler units were shipped worldwide in 2024.

What is an Opportunity for the Dental Equipment and Consumables Market?

Governments are involved in investment in awareness programs of oral health and dental health, introduction of oral health programs in the community, and subsidization of dental care to make them more accessible and affordable.

The high rate of technological development of dental instruments, including digital imaging, computer aided-computer assisted machineries, and minimally invasive equipment, is proving to be a new area of innovation and efficiency in dental procedures. The high acceptance of advanced dental products is being encouraged by the availability of supportive government policies that encourage dental industry research and development, as well as incentives and subsidies in oral healthcare programs.

➤ Get the Full Report @ https://www.precedenceresearch.com/dental-equipment-and-consumables-market

Dental Equipment and Consumables Market Challenges

What is the Limitation for the Dental Equipment and Consumables Market?

The manufacturing procedure of dental equipment is a complicated one, which includes the skills of highly qualified specialists and the utilization of complex materials and equipment. These will significantly increase the cost of production, which implies that the companies will have to raise the retail price of their products.

Consequently, dental procedures have become costly, making them not accessible to patients with the middle- and low-income brackets. The excessive cost of equipment as well as treatments is a key limitation that prevents market expansion.

Dental Equipment and Consumables Market Report Coverage

| Report Attributes | Statistics |

| Market Size in 2024 | USD 34.56 Billion |

| Market Size in 2025 | USD 36.99 Billion |

| Market Size in 2031 | USD 55.63 Billion |

| Market Size by 2034 | USD 67.75 Billion |

| Growth Rate 2025 to 2034 | CAGR of 6.96% |

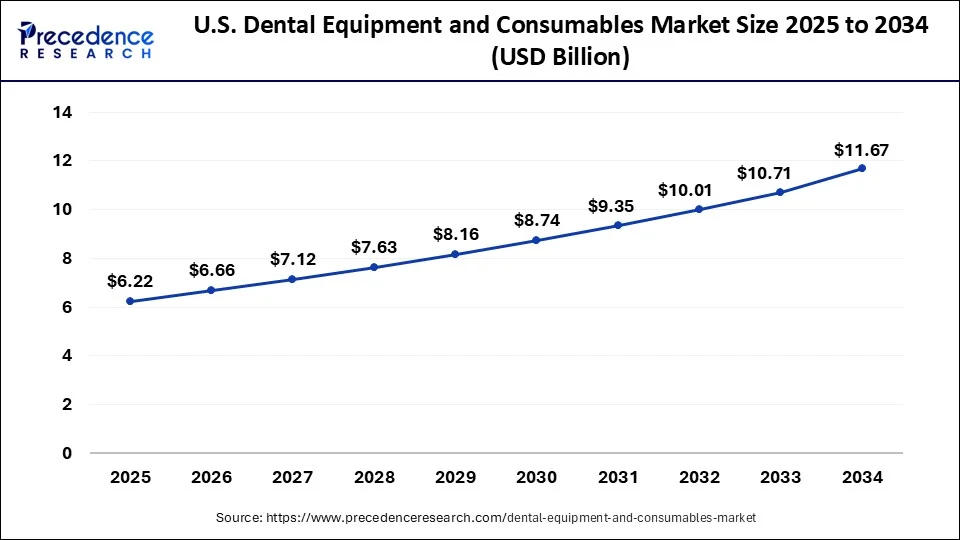

| U.S. Market Size in 2025 | USD 6,220 Million |

| U.S. Market Size by 2034 | USD 11,670 Million |

| Leading Region in 2024 | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End-user, and Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

| Key Players | A-Dec Inc., Planmeca Oy, Dentsply Sirona, Patterson Companies Inc., Straumann, GC Corp., Carestream Health Inc., Biolase Inc., Danaher Corp., 3M ESPE, and others. |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Dental Equipment and Consumables Market Regional Insights

How big is the U.S. Dental Equipment and Consumables Market?

The U.S. dental equipment and consumables market size was evaluated at USD 5.81 billion in 2024 and is predicted to surpass around USD 11.67 billion by 2034, growing at a CAGR of 7.22% from 2025 to 2034

How North America Dominated the Dental Equipment and Consumables Market?

North America dominated the market in 2024, due to the advanced infrastructure in the healthcare sector and the presence of the market giants of dental equipment production in the U.S. and Canada. The demand has been caused by the modification of lifestyles, consumption of processed food, and increased rates of oral health conditions, especially among the youth.

Also, the emphasis on prophylactic treatment and routine dental visits has led to the prevalence of the most recent dental technology in clinics and hospitals. The rise in the market has also been occasioned by the government, which has supported healthcare developments and increased awareness regarding oral health.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/3952

What Makes Asia Pacific Rapidly Growing Marketplace for Dental Equipment and Consumables?

Asia Pacific experiences the fastest growth in the market during the forecast period, due to rapid investments in healthcare and pharmaceutical industries in countries like China, India, and Japan. Moreover, urbanization and changes in life habits have increased the use of sugar-rich foods and junk foods, which has increased the prevalence of oral diseases among young people.

Oral healthcare awareness, infrastructure advancement, and insurance coverage are being invested in by governments and private players; as a result, oral healthcare treatment is becoming more accessible.

Dental Equipment and Consumables Market Segmentation Insights

Product Insights

Why did the Equipment Segment Dominate the Dental Equipment and Consumables Market?

The equipment segment dominated the market in 2024, because the prevalence of oral health problems and the need to employ advanced technologies in the field of diagnostic and treatment increased. Dental equipment is essential in improving the accuracy, efficiency, and quality of dental practice, and the dental practitioners can be more precise in carrying out duties like diagnosis, restorations, and surgeries. Adoption has also been further enhanced by the continued innovation in technology, such as the development of digital imaging systems, CAD/CAM units, and even laser dentistry equipment.

The consumables segment is the fastest-growing in the market during the forecast period. Consumables, which encompass one-time use products like cotton rolls, saliva aspirators, cannulas, impression trays, prosthesis, and restorative products, are required in almost all dental procedures. They are convenient, cheap, and required in various fields of dentistry, thus constant demand. Moreover, increased consumption of these products has been caused by the growth of dental practices across the world, coupled with increased oral healthcare awareness.

End-user Insights

Which End-user Segment Held the Largest Share of the Dental Equipment and Consumables Market?

The dental clinics segment held the largest share in the market in 2024, because they have employed trained professionals who include dentists, orthodontists, and oral surgeons who know about undertaking complex treatments such as implants, restorations, and surgery.

They also have specialized technologies, as well as advanced tools, such as diagnostic imaging devices, CAD/CAM systems, and surgical instruments, which are seen in clinics and guarantee precision and high-quality care. Furthermore, dental clinics are conveniently located and have more accessibility to the patient than hospitals, with more personal care and at a reasonable and convenient cost.

The hospitals segment experiences the fastest growth in the market during the forecast period. Hospitals are full-service treatment facilities, and they have emergency dental care, oral surgery, and restorative services. Hospitals are focusing on the development of modern dental infrastructure and consumables to increase their services.

The hospitals also enjoy close government support, well-developed medical facilities together with large-scale funding, which enables them to absorb new dental technology faster compared to smaller clinics. Moreover, with more knowledge about oral health, patients are visiting hospitals to seek more complicated and specialized interventions, which demand the assistance of multiple professionals.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Dental Equipment and Consumables Market Top Companies

| Company | Headquarters | Product/Service Landscape |

| A-Dec Inc. | Newberg, Oregon, USA | Dental chairs, delivery systems, dental lights, and sterilization solutions. |

| Planmeca Oy | Helsinki, Finland | Digital imaging (3D/2D), CAD/CAM, dental units, software for clinics and education. |

| Dentsply Sirona | Charlotte, North Carolina, USA | Wide range including imaging, CAD/CAM systems, treatment centers, and consumables. |

| Patterson Companies Inc. | St. Paul, Minnesota, USA | Dental and veterinary products; supplies, software, and services including digital solutions. |

| Straumann | Basel, Switzerland | Specializes in dental implants, prosthetics, orthodontics, and digital dentistry systems. |

| GC Corp. | Tokyo, Japan | Dental materials (cements, composites), laboratory equipment, and oral health care products. |

| Carestream Health Inc. | Rochester, New York, USA | Digital imaging solutions including radiography and 3D imaging for dental professionals. |

| Biolase Inc. | Foothill Ranch, California, USA | Dental lasers for soft tissue and hard tissue procedures. |

| Danaher Corp. | Washington, D.C., USA | Owns multiple dental companies (e.g., KaVo Kerr); focuses on diagnostics, imaging, and tools. |

| 3M ESPE | St. Paul, Minnesota, USA | Dental materials including adhesives, composites, impression materials, and prevention tools. |

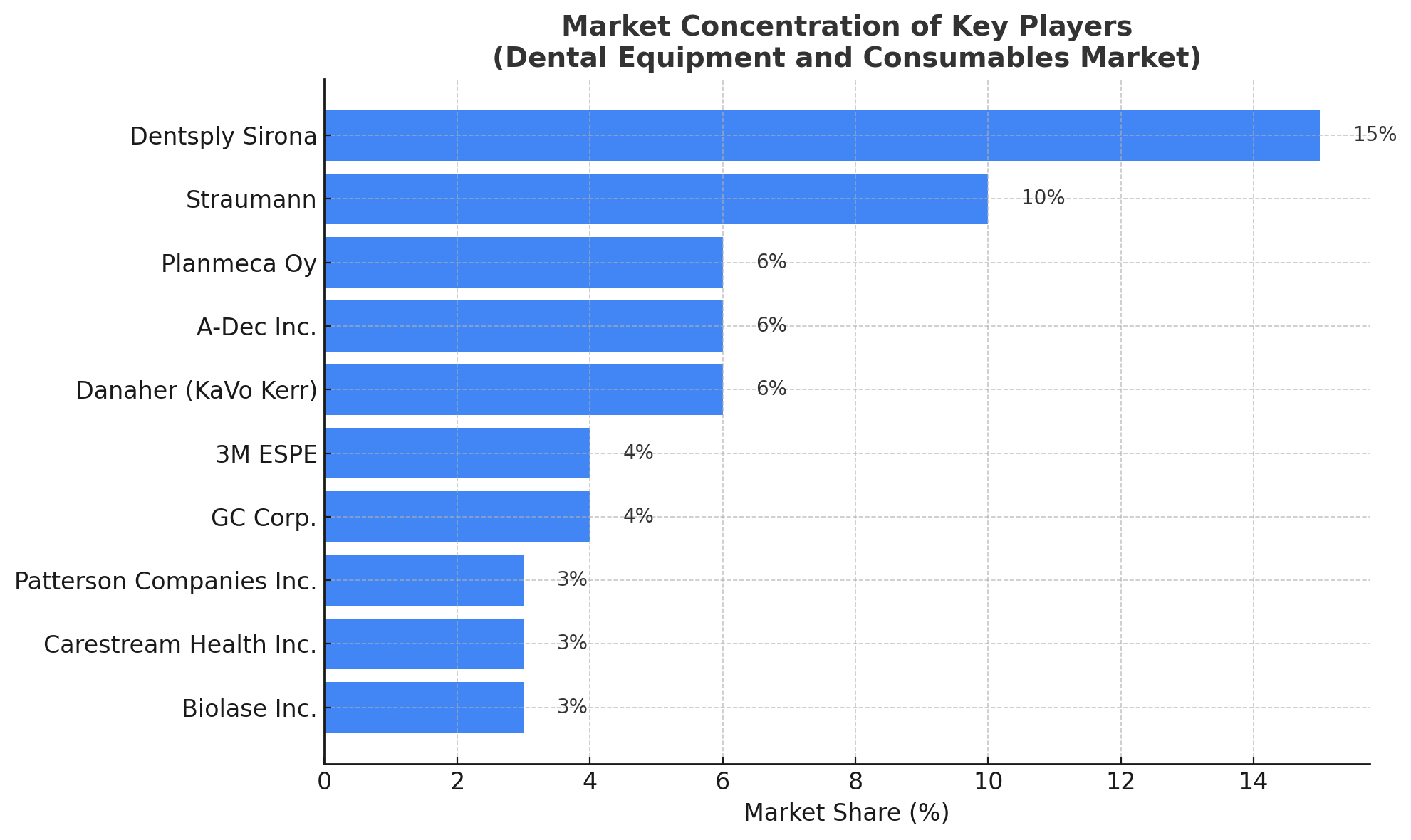

Dental Equipment and Consumables Market Concentration of Leading Companies

Source: Precedence Research

The dental equipment and consumables market is moderately concentrated, with a few global leaders holding strong influence while many smaller and regional players compete in niche categories. The largest companies dominate due to their wide product portfolios, continuous innovation, and established global distribution networks.

- Top 5 global players – A-Dec, Planmeca, Dentsply Sirona, Straumann, and Danaher (KaVo Kerr) – together control around 45–50% of the market. Their leadership is strongest in advanced dental equipment such as CAD/CAM systems, digital imaging, and dental chairs.

- Dentsply Sirona is the clear leader with an estimated 12–15% share, driven by its full-spectrum offering across imaging, treatment centers, consumables, and CAD/CAM technologies.

- Straumann holds a dominant position in the dental implants and prosthetics segment, representing nearly 8–10% of the global market.

- Planmeca and A-Dec are leaders in dental units and chair systems, together contributing about 10–12% share.

- Danaher (KaVo Kerr) and 3M ESPE strengthen overall concentration with a combined 10% share, particularly in imaging solutions, restorative materials, and preventive products.

- GC Corp., Patterson Companies, Carestream Health, and Biolase make up 2–5% each, with strengths in consumables, distribution services, digital imaging, and dental laser technology.

Overall Insight:

The market shows a moderate-to-high level of concentration at the top, where global giants set innovation trends and influence pricing. However, the consumables segment remains more fragmented, with regional and specialized manufacturers actively competing on price and accessibility.

This balance between global leaders driving technology adoption and smaller players fueling affordability is a defining feature of the dental equipment and consumables industry.

Dental Equipment and Consumables Market Recent Developments

- In January 2025, Septodont Inc. and Premier Dental introduced BufferPro, an 8.4% solution of sodium bicarbonate as a buffering agent to simplify the administration of local anesthetics in dentistry. BufferPro is a one-step, sterile, single-use capsule that includes 0.1 mL of sodium bicarbonate, which increases the pH of anesthetic cartridges to approximately physiological levels, increasing the onset time and decreasing the procedural discomfort. (Source: https://www.septodontusa.com)

- In April 2024, Ivoclar Group announced its collaboration with the U.S.-based technology company SprintRay. This partnership is expected to create new standards in 3D printing for the dental sector, where dentists, dental technicians, and hygienists can have increased functionality. (source: https://www.ivoclar.com)

- In June 2023, A-dec introduced its digital connected transport system and dental chair, which will be a major technological advance in the dental field. A-dec 300 Pro and A-dec 500 Pro delivery systems are currently available in the North American markets. (source: https://www.businesswire.com)

Case Study: Adoption of Digital Dentistry in a Mid-Sized U.S. Dental Chain

Background:

SmileCare Dental Group, a mid-sized dental chain with 20 clinics across the U.S., faced rising patient demand for faster, less invasive, and more precise dental procedures. The group relied heavily on traditional equipment and consumables, leading to longer treatment times, inconsistent quality in prosthetic fittings, and higher costs for both patients and the clinic.

Challenge:

The clinic network needed to reduce turnaround times for procedures such as crowns, bridges, and implants, while also cutting costs and improving patient experience. Their legacy workflow involved outsourcing prosthetic fabrication, which often took 2–3 weeks. Patient dissatisfaction was increasing, and the clinics were struggling to remain competitive against practices adopting digital dentistry technologies.

Solution:

In 2023, SmileCare invested in upgrading its infrastructure with CAD/CAM systems, intraoral scanners, and digital imaging equipment from leading providers like Planmeca and Dentsply Sirona. The group also standardized consumable usage by adopting ceramic blocks, resin-based composites, and ultrasonic scalers to enhance both restorative and preventive dental care. Training programs were implemented to upskill 150+ dental professionals across the network.

Implementation Outcomes:

- Treatment Efficiency: Prosthetic production (crowns, bridges) was reduced from 2–3 weeks to same-day or 48 hours through in-house CAD/CAM systems.

- Cost Reduction: Outsourcing costs for lab work decreased by 40%, while consumable standardization lowered procurement overhead.

- Patient Satisfaction: Surveys reported a 32% increase in patient satisfaction scores, primarily due to reduced waiting times and higher precision in fittings.

- Revenue Growth: SmileCare experienced a 19% increase in revenues in 2024, driven by higher patient retention and an influx of new patients attracted by advanced treatment options.

-

Sustainability: Adoption of digital impressions reduced plaster and alginate waste, aligning with eco-friendly healthcare trends.

Key Takeaway:

The SmileCare case demonstrates how investment in dental equipment and consumables innovation directly improves clinical efficiency, reduces costs, and enhances patient experience. With supportive U.S. healthcare policies and growing oral care awareness, such transformations underline why North America holds a dominant share of the dental equipment and consumables market, while also showcasing how digital dentistry adoption sets the growth benchmark for the Asia Pacific and other emerging markets.

Dental Equipment and Consumables Market Segmentation

By Product

- Equipment

- Consumables

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Dental Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/dental-equipment-and-consumables-market

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Dental Consumables Market : Explore how essential dental materials and products are driving oral healthcare efficiency and patient outcomes.

➡️ Refurbished Dental Equipment Market: Learn how refurbished dental tools are offering cost-effective, sustainable solutions for dental practices.

➡️ Dental Equipment and Maintenance Market: Discover how advanced dental equipment and reliable maintenance services are improving clinical performance.

➡️ Dental Diagnostic and Surgical Equipment Market: See how cutting-edge diagnostic and surgical devices are enabling precision in dental treatments.

➡️ Dental Hygiene Devices Market: Understand how innovative hygiene devices are enhancing preventive dental care and patient comfort.

➡️ Healthcare Consumables Market: Explore how consumable medical supplies are ensuring safety, efficiency, and continuity in healthcare delivery.

➡️ Veterinary Dental Equipment Market: Discover how specialized dental equipment is supporting oral health and treatments for animals.

➡️ Dental Chair Market: Learn how ergonomic and technology-enabled dental chairs are improving treatment experiences for both patients and dentists.

➡️ Urodynamic Equipment and Consumables Market: See how advanced urodynamic solutions are transforming diagnosis and management of urinary disorders.

➡️ Dental Preventive Supplies Market: Explore how preventive dental products are reducing oral health risks and supporting long-term wellness.

➡️ Dental Suction Systems Market: Understand how efficient suction systems are ensuring hygiene, safety, and smooth workflows in dental practices.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.